This piece was originally published in Naavik Digest, a video game industry newsletter. I played a role in scaling Naavik following its acquisition of my gaming media business, The Pause Button, in early 2021.

FaZe Clan, the popular esports and entertainment company, is officially planning to go public via a SPAC. Not only will it rock the ticker symbol $FAZE, but it’s looking to support a $1 billion dollar price tag. The implications behind the move are massive, but the company’s financial profile leaves me skeptical about where it plans to go from here. Let’s dig in deeper.

For the better part of the last year, I’ve been thoroughly convinced that creators are going to play an increasingly important role in shaping the future of the games industry. The speed at which these content-centric companies can create culturally relevant moments and then monetize them through merchandising or partnerships isn’t something that a standard publisher can match. The cultural currency that these brands collectively command is often enough to make or break entire games or companies at their discretion.

The issue, however, with content-driven companies like FaZe Clan, is the natural scalability constraints of content production. One person can only edit so many videos, record so many podcasts, or write so many newsletters without the business having to increasingly pour more money into making bigger and better content or hiring more people to increase the rate of production. These constraints limit overall output, which therefore limits the financial growth and potential upside of a business like FaZe. Profitable scalability must also come from additional diverse sources.

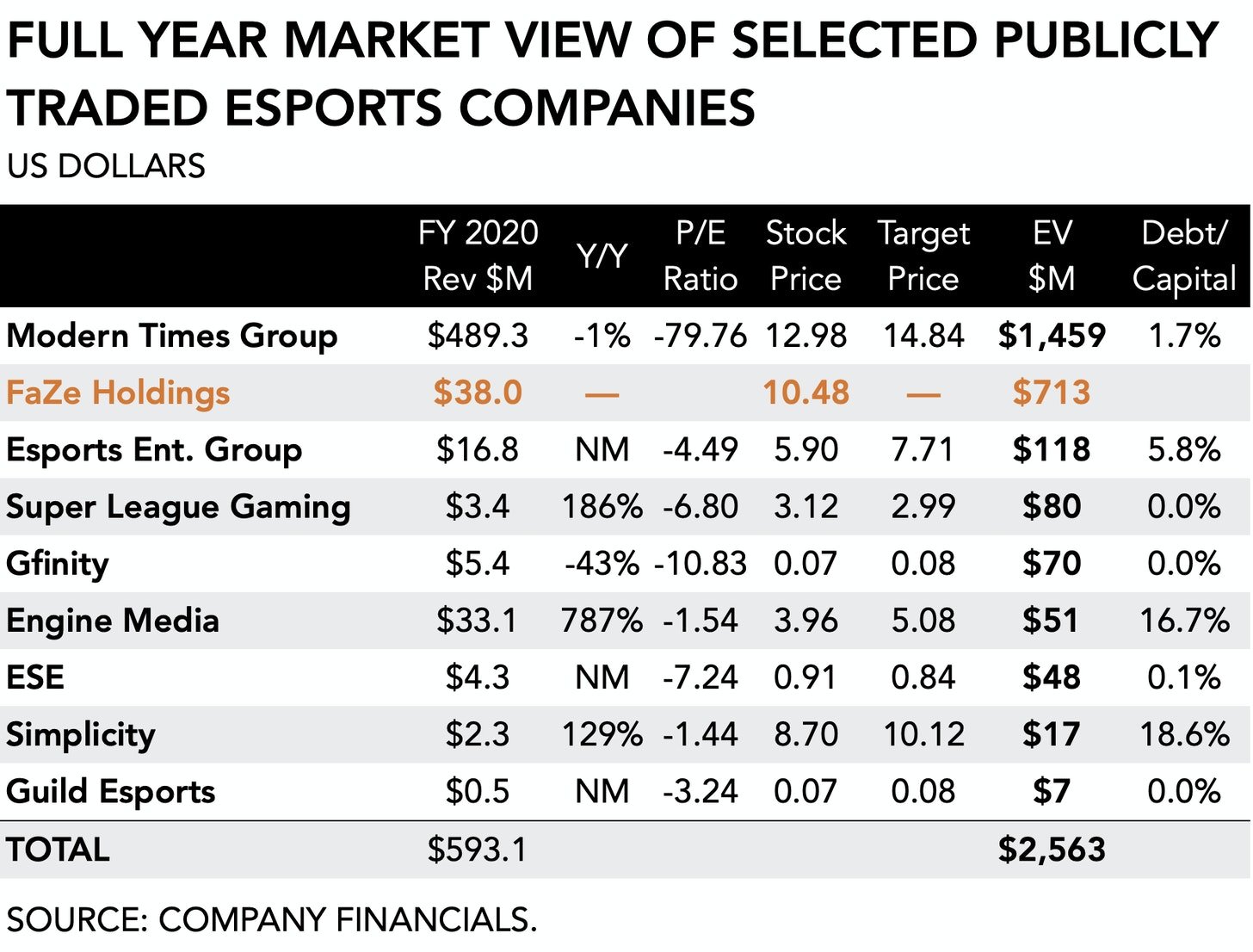

Unfortunately, being a publicly traded esports company to date has typically not been a profitable venture, and most companies like FaZe have struggled to create diverse, scalable revenue streams. As Joost Van Dreunen pointed out in his excellent breakdown of FaZe’s public offering, most esports / content companies fairly universally remain unprofitable and support negative P/E ratios as a result.

The truth behind the numbers is that most of these businesses have yet to find revenue streams that are substantive and consistent enough to offset the value that content (read: brand deals + sponsorships) can bring. Esports presents opportunity, but it’s difficult to forecast substantive revenue based on teams of consistently rotating players playing games with constantly changes metas. Even with more stable league-based structures like the Call of Duty League (CDL) popping up, we’re still very much in the early days of gaming “leagues” and even further away from teams like FaZe receiving the kind of consistent advertising or media deals that teams in leagues like the NFL or NBA receive.

While FaZe doesn’t need to replace content completely, it does need to have other revenue sources that can rival it in the case of another “adpocalypse.” For context, in 2020 brand sponsorships and content production made up $29 million of the company’s $38 million in revenue (76%), merchandise contributed $7 million (18%), and esports earnings of $3 million (8%) made up the remainder. And, of course, the margin profiles between these business lines ranges quite a bit. On paper, having four multi-million dollar revenues streams is certainly nothing to scoff at, but it’s likely not enough to justify a $1 billion valuation.

FaZe knows this, which is why they referenced multiple new — and theoretically more stable — revenue streams in a recent 8K filing. Most notably, FaZe mentioned building a “metaverse” via NFTs and expanding its offerings through M&A. However, NFTs are a pretty nascent industry, and M&A comes with its own host of complexities and risks. It feels somewhat premature to denote that either will become the second or third biggest revenue generators for the company, and it’s even more premature to assign a ten-digit valuation to a low-margin company that’s betting the house on a set of offerings that are still in their earliest innings.

That said, if anyone can figure it out it will be FaZe Clan. The company already reinvented itself from a small group of Call of Duty trickshotters into a publicly traded company, and it managed to amass an incredibly dedicated fan base in the process. The fact that being a FaZe fan is more “lifestyle” than it is a fandom means that if the company actually can bring exciting new business models to market outside of content, it won’t have to look very far to find a rabid group of consumers ready to spend money on it. It just remains to be seen what exactly that big new moneymaker will be, how much it can scale, and therefore how much it can really help FaZe become a unicorn.